Corporate Demand Drives Clean Energy

By: Misti Groves, SVP U.S. Strategy

Companies that voluntarily buy clean energy play a critical role in clean energy projects being built. Without extensive voluntary commitments by corporate buyers to purchase clean energy, fewer projects will be financed and built, and the U.S. will struggle to meet growing energy demand.

Over the past decade, corporate clean energy procurement has accounted for more than 40% of new U.S. clean energy capacity additions. Corporate procurement enables companies to meet sustainability goals, hedge against unpredictable energy prices, and support the U.S. electricity grid’s expansion and resilience.

The U.S. is demanding more electricity than ever, driven by the rise in artificial intelligence, increased electrification, and resurgent U.S. manufacturing. To meet this demand efficiently and cost-effectively, the U.S. needs to build a lot more clean energy — and fast.

Why Is Corporate Demand for Clean Energy So Important?

A recent CEBA-commissioned study analyzed the scale of impact that corporate offtake provides. Until now, there have been limited data points to show the extent to which long-term corporate virtual power purchase agreements (VPPAs) enable energy projects to get financed. This study shows how truly vital corporate offtake is in energy projects being built and bringing energy to the grid.

A VPPA is a financial contract between a company and a renewable energy project where the company agrees to buy the project’s power at a fixed price, but without taking physical delivery of the electricity, often contracted for 8-15 years. Corporate buyers guarantee a price for electricity, insulating the projects from the ups and downs of market electricity prices and making it possible for projects to get financing. This long price guarantee from the company gives lenders the assurance they need to provide capital for the project.

Without a corporate buyer, a project’s revenues are dictated by fluctuating wholesale electricity prices, also known as “merchant revenue.” Variability in merchant revenue can lead to periods where projects cannot meet their term debt obligations, resulting in financial distress. VPPAs – and, to a lesser, but still important, extent, renewable energy certificates (RECs) – are essential instruments to blunt these fluctuations.

VPPAs and RECs Provide Revenue Stability for Clean Energy Buildout

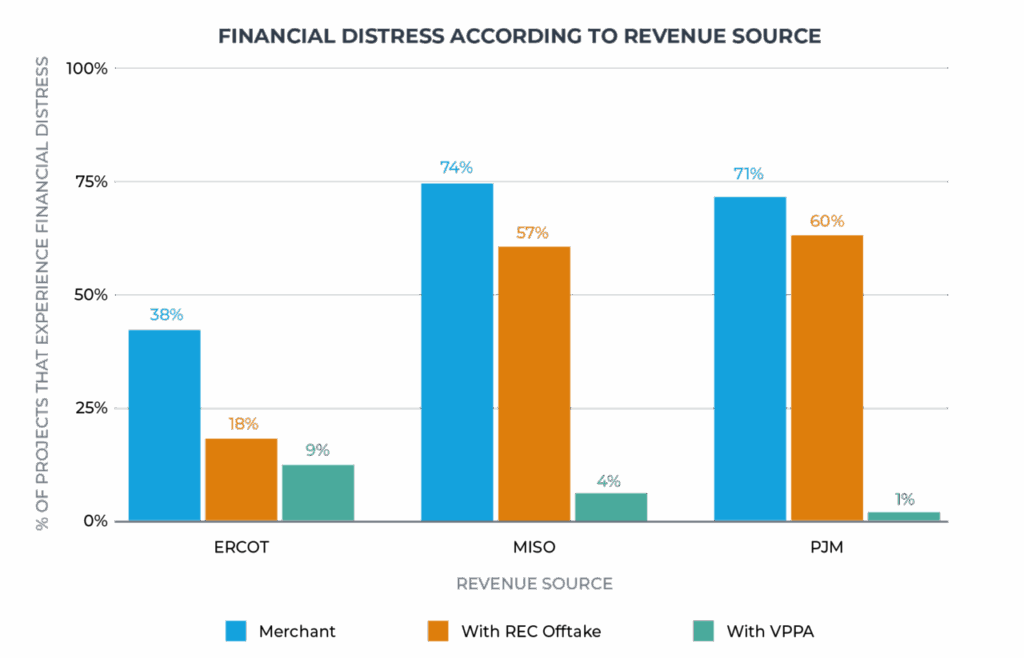

REsurety analyzed the economic performance of 251 wind and solar projects that operate in three major U.S. energy markets: ERCOT (Texas), MISO (Midwest), and PJM (Mid-Atlantic). Here’s what they found:

- Corporate VPPAs slash financial distress by up to 90% in key markets: By hedging against dynamic market prices, VPPAs provided the revenue stability to reduce the number of projects facing financial distress by approximately 80% in ERCOT and over 90% in MISO and PJM compared to the merchant scenario. This stability is critical for securing project financing.

- RECs reduce incidents of financial distress by up to 30%: While their impact is less substantial than VPPAs, unbundled REC purchases provide an additional revenue stream that can reduce financial distress compared to purely merchant projects. RECs do not directly mitigate wholesale power price volatility. However, higher REC revenue can lead to more significant reductions in financial distress.

Conclusion

Corporate clean energy agreements are essential to the financing and construction of the electricity generation we need. As the demand for electricity continues to surge and the grid requires rapid, cost-effective generation, the continued involvement of corporate procurement is more critical than ever to ensure the necessary clean energy build-out. As load growth continues, corporate participation and recognition are necessary to accelerate clean energy additions to the grid.