Scope 2 Revisions Should Empower, Not Exclude, Mid-Sized Energy Buyers

By Jay Creech, REI Co-cop

As of January 13, there are less than 20 days left for respondents to participate in the GHG Protocol’s public consultations. One of its central proposals is to require hourly matching and deliverability for market-based accounting. CEBA’s response will continue to urge the Protocol to keep hourly matching and deliverability optional. However, if hourly matching becomes a requirement, it is imperative that the Protocol design exemptions which consider extensive energy buyer feedback and are based in market realities.

In response to feasibility concerns regarding the hourly matching requirement, the GHG Protocol has suggested exemptions for companies with smaller loads. The proposed exemption thresholds imply that only small companies might struggle with the hourly matching requirement. CEBA challenges this assumption. We think the thresholds are not rooted in market reality and risk chilling voluntary procurement.

In this blog post, CEBA member REI Co-op is sharing their viewpoint. It illustrates how the current thresholds might adversely impact a company that is clearly bigger than those targeted for exemptions. CEBA appreciates REI’s willingness to share this viewpoint and encourages energy buyers to submit comments to contribute their perspectives to the public consultation ahead of the January 31 deadline.

REI’s Case: Big Enough to Matter

As a specialty outdoor retailer with a distributed footprint, REI Co-op has been purchasing clean energy for over a decade, focusing on making these purchases local to its footprint and structured to increase the accessibility of impactful clean energy for buyers of all sizes.

REI consumes roughly 85,000 MWh annually, translating to 30–35 MW of clean energy demand. Its clean energy portfolio includes on-site solar, multi-year REC purchases, and a VPPA that REI and outdoor retail peer Carhartt recently co-signed in ERCOT.

This 18.5 MW VPPA—small by VPPA standards—was only possible because two buyers aggregated their demand. Under proposed Scope 2 revisions requiring location and hourly matching, this transaction likely would not have occurred. Neither buyer had sufficient load in ERCOT. In addition, other markets are more challenging to access for mid-sized buyers, meaning that finding a similar VPPA outside of ERCOT may simply not have been viable.

Why Mid-Size Clean Energy Buyers Matter in the Scope 2 Debate

REI sits in the middle of the spectrum of clean energy buyers —a clean energy buyer with a defined strategy and demonstrated impact, yet by most metrics, they would be considered a mid-sized buyer.

Mid-size corporate buyers represent a significant and growing share of the carbon emissions-free energy procurement market. Many of these buyers are motivated to add clean energy where they operate, and their collective impact, alongside supply chain partners and peer companies, is highly significant.

Unfortunately, the Scope 2 revisions conversation often highlights, almost exclusively, buyers on two ends of the spectrum:

- Small buyers with distributed loads small enough to be exempt from time (but not location) matching requirements.

- Large buyers capable of transacting multiple utility-scale power purchase agreements (PPAs) across regions.

Clean energy procurement shouldn’t be framed as a choice between “too small to matter” and “big enough to adapt.”Reporting thresholds should carefully consider the impacts on the majority of clean energy buyers and the practicality of procuring hourly clean energy at a single-digit MW size. Mid-size buyers represent a critical link in scaling clean energy adoption. Setting thresholds that don’t consider the procurement realities of mid-sized buyers risks slowing progress toward a decarbonized grid.

The Overlooked Middle Market

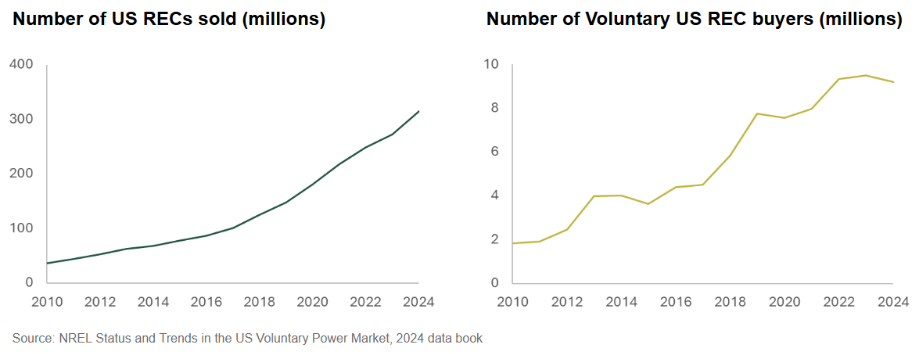

Millions of organizations voluntarily procure clean energy every year. Just within the US in 2024, over 9 million buyers purchased over 300 million RECs.

REI is representative of this larger group. The retailer has distributed operations and strong sustainability commitments but faces significant barriers to accessing clean energy.

Common challenges include:

- Minimum offtake requirements that exceed load.

- High transactional costs, such as months of negotiations for VPPA-style transactions that for a mid-size buyer might only cover a few megawatts.

For many mid-size buyers, these hurdles make traditional clean energy transactions inefficient, or infeasible, for both the buyer and the developer.

The Risk of Narrow Rules

If Scope 2 revisions impose strict hourly and location matching, companies with distributed loads will face a more complex and difficult procurement landscape and fragmented and burdensome accounting obligations.

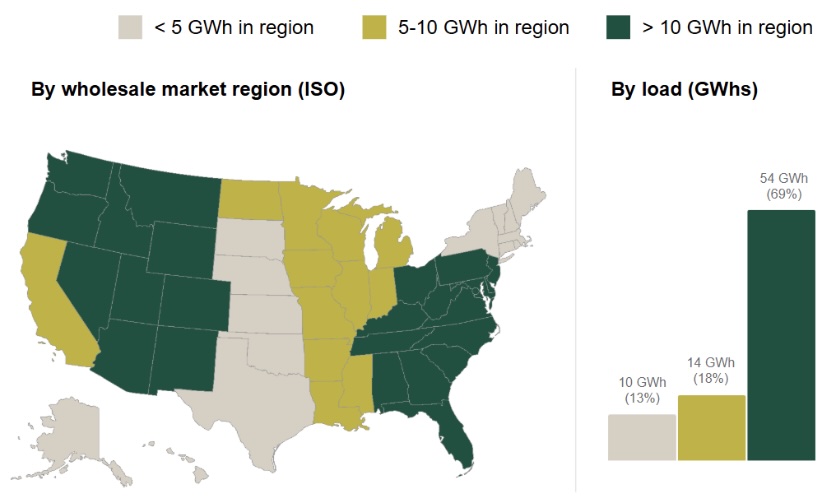

The figure below shows where REI’s electricity load would fit into the proposed options for two of the frequently discussed GHGP Scope 2 hourly matching exemptions (5 and 10 GWh per year). The figure assumes market boundaries will be set to match wholesale markets (i.e., ISOs), though the market boundaries are still being defined.

If the load threshold is set to 5 GWh at wholesale market boundaries, REI would be subject to hourly matching for 87% of its electricity consumption. With a 10 GWh threshold, REI would be subject to hourly matching for 69% of its electricity consumption. Even in the scenarios where REI would exceed 10 GWh in a market boundary, electricity demand within those market boundaries would likely be in the single digit MWs.

This means REI and a clean energy developer would need to hourly match a project share of less than 10 MW, a transaction size that is generally not feasible. Moreover, some regions may fall below thresholds, while others will require complex treatment for matching adding significant administrative accounting burdens.

Set Thresholds that Maximize Decarbonization Impact

Standards should empower, not exclude, voluntary buyers of clean energy of all sizes and continue to enable the procurement of as much clean energy as possible. REI is one of many mid-sized buyers seeking impact through their voluntary procurement, but who have loads that may be too small or distributed for hourly matching under the currently proposed exemption thresholds. If the GHG Protocol decides to make hourly matching and deliverability a requirement, exemption thresholds should take into account the procurement context of such buyers.