CEBA Report: Repealing Clean Energy Tax Credits Would Raise Electricity Prices for American Families and Job Creators Across the United States

Average household utility bill would rise by more than $110 per year, while businesses would see at least a 10% increase, to be passed on to consumers

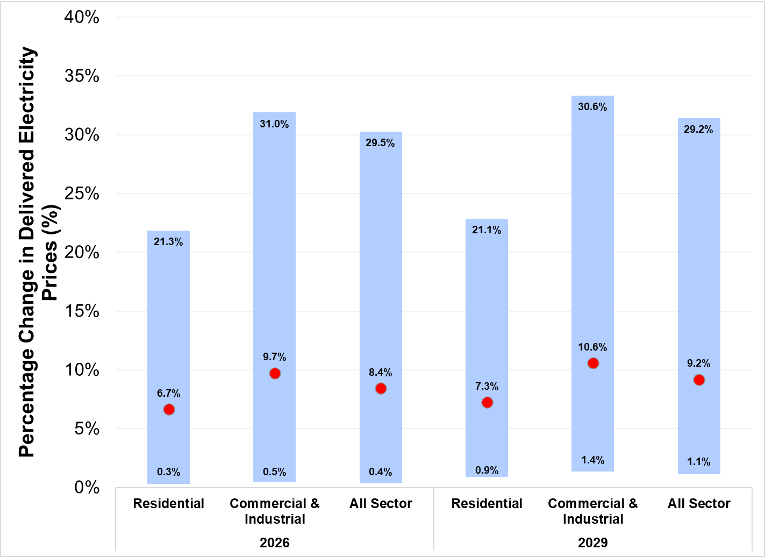

CEBA today released a study conducted by NERA Economic Consulting showing that repealing the federal clean energy technology-neutral investment (§48E) and production tax credits (§45Y) would raise average U.S. residential electricity prices by nearly 7% by 2026 – equating to an average yearly increase of more than $110 for the average American residential customer.

For American businesses, electricity bills would increase by about 10% by 2026 if the tax credits are repealed, with costs likely passed on to consumers in the form of higher prices for goods and services. Additionally, repealing the credits would decrease available capacity on the grid by 167 gigawatts (GW) at a time when generation is critical to supporting the 21st century industries of America such as artificial Intelligence and advanced manufacturing, to win the economic race against China.

“Combating the cost-of-living crisis for American consumers and fueling U.S. economic growth relies on more private investment in a diverse menu of clean energy sources,” said CEBA CEO Rich Powell. “Maintaining the federal investment and production tax credits will enable electricity producers, buyers, and their customers to supply an abundance of low-cost energy sources. Weakening or repealing these provisions would unequivocally mean higher electricity costs for U.S. households and businesses, especially in America’s heartland.”

Repealing the tech-neutral tax credits would increase overall electric rates because of the pressure placed on existing supply and increased prices for any additional supply. Put simply, without the credits, the new marginal price for resources would go up, in turn meaning higher electric prices for Americans. Further, Midwestern and Western states’ residential electricity prices would rise by about 12% and 10%, respectively, over the course of the next four years – the highest increases for any regions in the country.

The investment tax credit (§48E) and the production tax credit (§45Y) provide a tax cut for American innovative clean energy sources including nuclear, hydropower, geothermal, biofuel, wind, and solar. Without these tax credits, by next year, the average increase in electricity prices for both businesses and residences in the lower 48 states would be at least 8.4%, with numerous states seeing double-digit price inflation. Because the study offers conservative estimates, the electricity price hikes could be even higher.

State-Specific Findings

The study shows how electricity prices would rise over the next year in certain states if the tax credits are repealed:

- Wyoming: The average electricity prices for both businesses and residences would rise by nearly 30%.

- Kansas: The average electricity prices for both businesses and residences would rise by over 15%.

- Missouri: The average electricity prices for both businesses and residences would rise by over 15%.

- South Carolina: The average electricity prices for both businesses and residences would rise by nearly 15%.