Mapping the Momentum: Where Clean Firm Energy Is Taking Off and Who’s Behind It

As U.S. energy demand rises, corporate buyers are seeking new clean firm generation resources to provide reliable, carbon emissions-free electricity to power their growing operations.

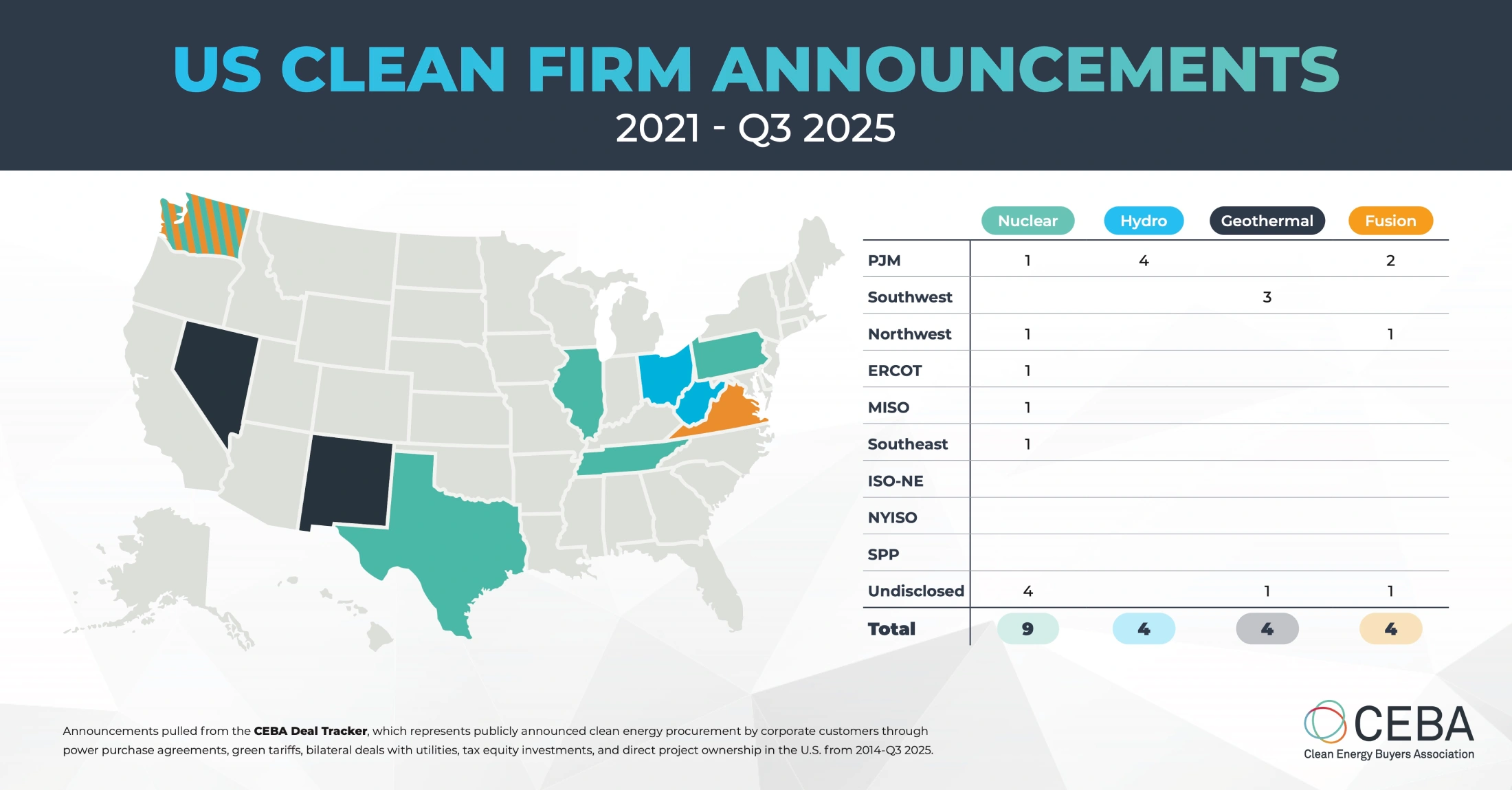

- CEBA has tracked over 6 gigawatts (GW) of corporate commitments to new clean firm energy projects across 10 states, with the first public announcement occurring in 2021.

- Over half of the new clean firm capacity committed by corporates was announced in 2025.

- Timelines for corporates to meet goals are dependent on projects coming online in a timely fashion, which could be enhanced by transmission and permitting reforms.

Clean firm energy refers to electricity sources such as nuclear (i.e., restarts of conventional nuclear and new advanced nuclear), geothermal, fusion, hydropower, long-duration energy storage, and thermal generation with carbon capture and storage (CCS) that can provide consistent, low-carbon or carbon emissions-free power on demand. This analysis focused on new nuclear, fusion, geothermal, and hydropower announcements from 2021 through Q3 (Sept. 30, 2025).

What Does the Data Show?

CEBA has tracked 21 clean firm deals in the U.S., involving nuclear, fusion, geothermal, and hydro projects. These deals, which are limited to new or qualified repowering projects, show that:

- CEBA’s members are driving this new high in clean energy growth. All but one of the 21 deals tracked involved a CEBA buyer.

- Corporate buyers are committing to clean firm technologies, with 2025 accounting for over half of the total announced to date. In total, corporate buyers announced 20.4 GW of new capacity — including all clean resources — in the first three quarters of 2025. Almost 17% (3.4 GW) of this capacity included new nuclear, fusion, geothermal, or hydro projects. This is a significant increase from last year, when projects involving these technologies comprised only 8% (1.9 GW) of the total. Notably, these totals include named projects and exclude broader collaborations announced. Therefore, this represents just a portion of the investment corporate buyers are making to scale new clean energy technologies. Buyers are also leading the way to reduce costs and show proof of concept of new technologies, sometimes first of a kind. These early buyer interventions have the power to reduce the longer-term costs and future project investments.

- PJM is a dominant target market. PJM comprises about a third of the projects and over a fifth of the capacity announced. As one of the most expensive markets in the U.S. for procuring clean energy, PJM continues to face challenges with limited project interconnections. Yet, it remains highly attractive to corporate buyers because it is home to a major global data center hub where many buyers operate — underscoring that location is a top priority.

Why Does This Matter?

The types of contracts vary across these announcements, but most are multiyear, sometimes even decades-long, deals. By committing to long‑term clean energy purchases, corporate buyers are helping accelerate the commercialization of emerging technologies and ensuring reliable access to power for the U.S. market well into the future.

- Private sector investments are delivering innovative, reliable energy solutions, and corporate commitments are critical to meeting growing energy demands.

- Buyers are seeking to use all resources, including clean firm technologies, to strengthen the reliability of the grid in the face of significant electricity demand growth. In the first three quarters of 2025, almost 17% of the announced capacity was for clean firm projects compared to around 83% for “traditional” clean projects — solar, wind, and battery storage.

Corporate buyers have played an instrumental role in spurring clean energy growth across the U.S. Buyers are now demanding that policymakers address the regulatory hurdles hindering the buildout of clean firm energy resources and supporting infrastructure to meet unprecedented electricity growth in America.

CEBA and its members are working with policymakers on these potential reforms, ensuring the clean firm technologies corporate buyers support come online to provide reliable, low-cost, carbon emissions-free energy needed to sustain a growing U.S. economy.

This analysis leverages data from the CEBA Deal Tracker. The CEBA Deal Tracker represents publicly announced procurement of clean energy by commercial and industrial customers through power purchase agreements (PPAs), green tariffs, bilateral deals with utilities, energy storage agreements, energy customer tax equity investments, and direct project ownership in the U.S. since 2014. This tracker only includes deals for new or qualified repowering clean energy projects.