Innovation, Ambition, and Impact Characterize Energy Customer Market in First Half of 2024

During May’s CEBA Connect: Spring Summit, CEBA’s 2024 State of the Market presentation highlighted three trends that defined the energy customer market since 2023: customers were 1) raising their level of ambition, 2) harnessing innovation, and 3) focused on aligning material impact with their clean energy procurement.

In conjunction with our latest CEBA Deal Tracker update, we’re sharing a series of blogs with our analysis and thoughts on the market. In these posts we’ll cover:

- Customer ambition and market growth

- Innovation and impact

- Accomplishments of CEBA members

Let’s get to it!

Momentum Grows in 2024

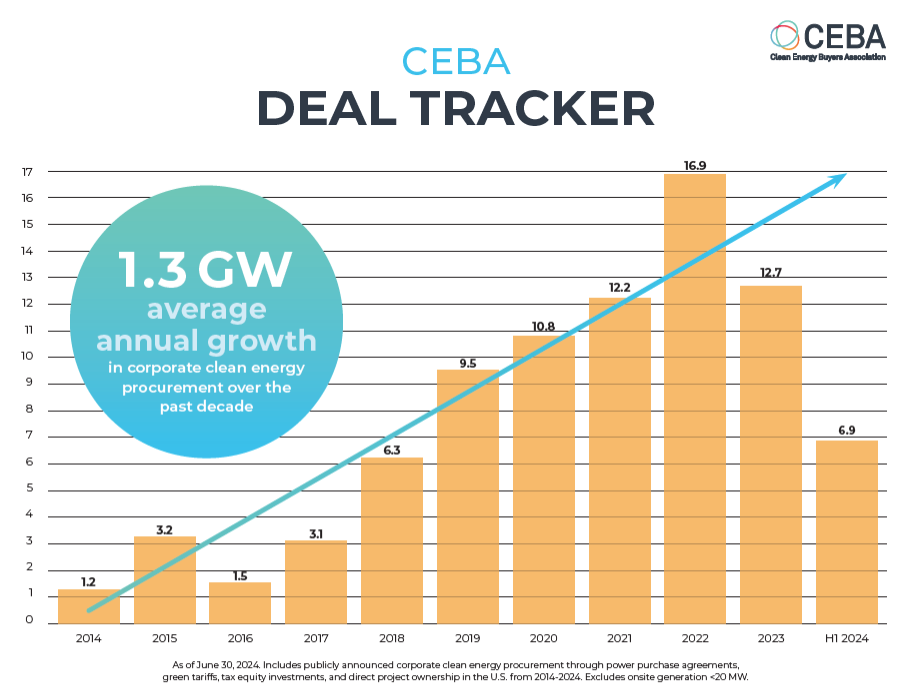

In the first six months of 2024, 32 corporate energy customers announced 6.9 GW of new, utility-scale clean energy across 64 wind, solar, and geothermal projects in the United States.

This newly announced capacity comprises nearly 10% of the more than 84 GW of U.S. corporate-driven clean energy tracked by CEBA since 2014. This includes more than 800 deals — an astounding 91% of which the CEBA community was involved in.

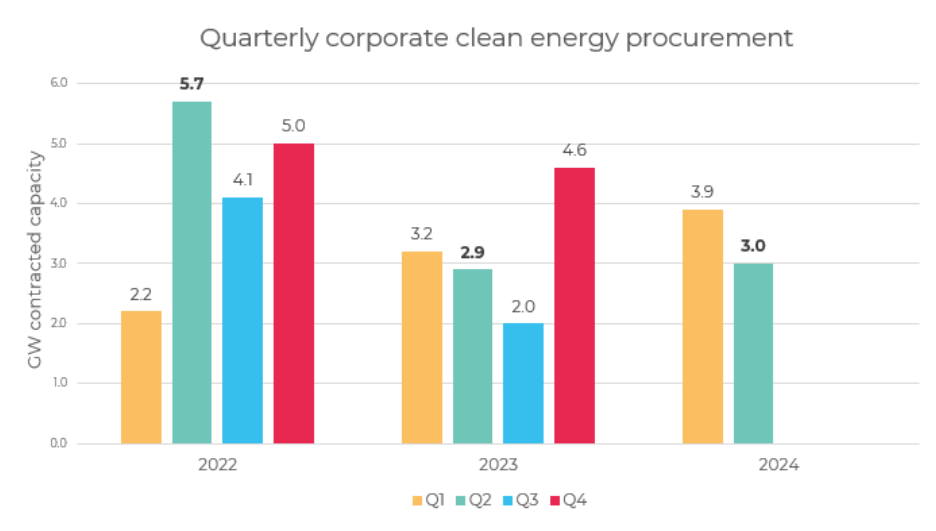

After years of constrained supply led to a rare annual downturn, the end of 2023 saw strong predictors of growing momentum for the customer-driven market. This has proven true through the first half of 2024, as the 3.9 GW procured by customers in Q1 outperformed the equivalent quarter of both 2022 and 2023. While the 3 GW procured in Q2 looked closer to prior quarters, the combined total for H1 2024 tracks ahead of the 6.1 GW procured through H1 2023 and indicates 2024 may be on track to outperform 2023’s end-of-the-year total.

New Customers Not Deterred

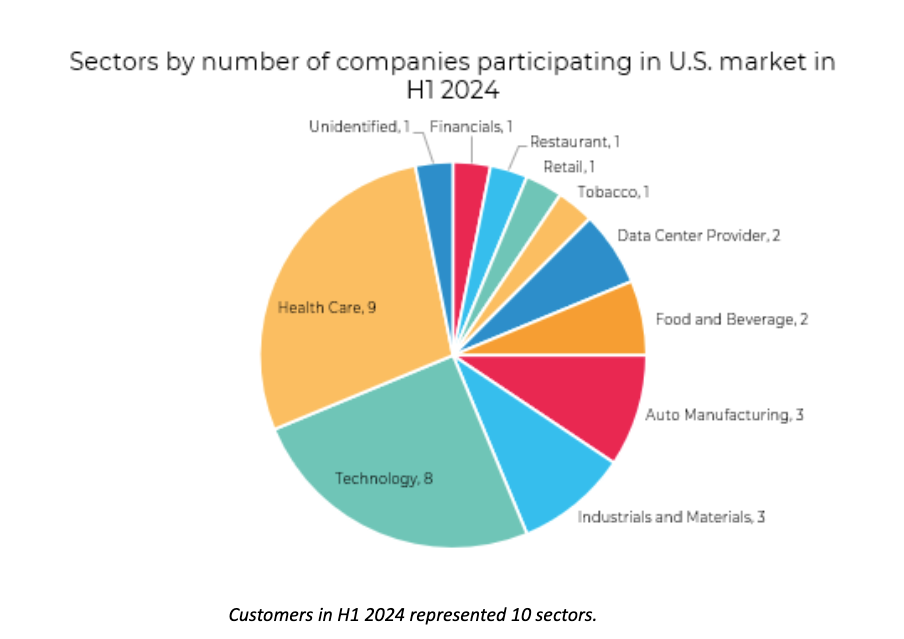

One indicator of growing demand and rising customer ambition is the rate at which new companies enter the U.S. clean energy market. More than 50% of the 32 customers in H1 announced their first-ever U.S. deal.

During H1, the health care sector had both the highest number of new customers and total customers of any commercial and industrial industry tracked by CEBA, five new and nine total companies transacting. This follows a record year for this sector in 2023, which saw its greatest year-over-year growth from 2022.

The technology and data center sectors had a combined 10 companies transacting for more than 60% of all capacity in H1, continuing the leadership of these sectors in overall capacity contracted.

Rising Ambition Leads to Expanding Market

The profile of the voluntary corporate energy customer has continued to evolve. Over the past decade, the market has grown from just 10 customers to more than 236 unique customers tracked by CEBA, having more than doubled over the past 5 years. As corporate energy customers continue to set ambitious targets, we expect the expansion of this market to continue.

Keep an eye out for the next post in this series where we’ll delve into how customers are harnessing ambition and focusing on material impact.

If you have information about a clean energy project your organization is involved with that you would like to share, please contact the CEBA team at communications@cebuyers.org. All information is kept confidential and is reported in the aggregate only.

The full CEBA Deal Tracker download is available for CEBA members on CEBA InterConnect.