Energy Attribute Certificate Issuing Bodies & Registries Need Clearance and Practical Tools to Expedite System Updates that Enable Next Generation Procurement

The Clean Energy Buyers Institute’s NextGen Activator workshop series is identifying the market system updates necessary to broaden the suite of carbon-free electricity procurement options so customers can optimize the decarbonization impact of their procurement decisions

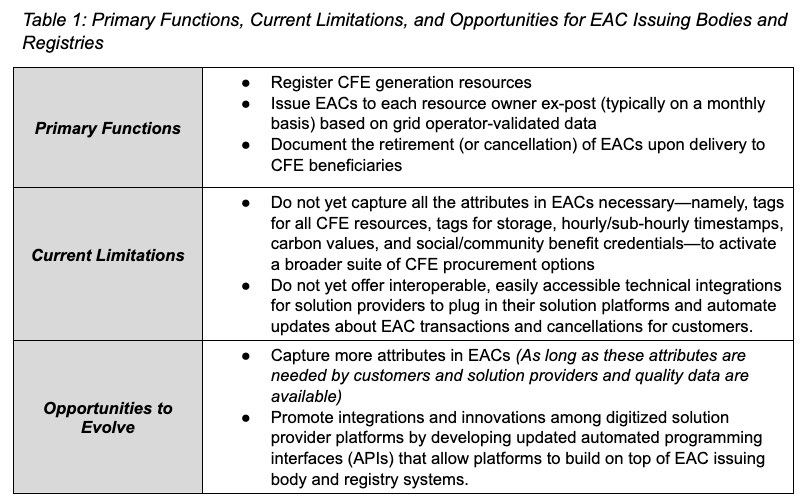

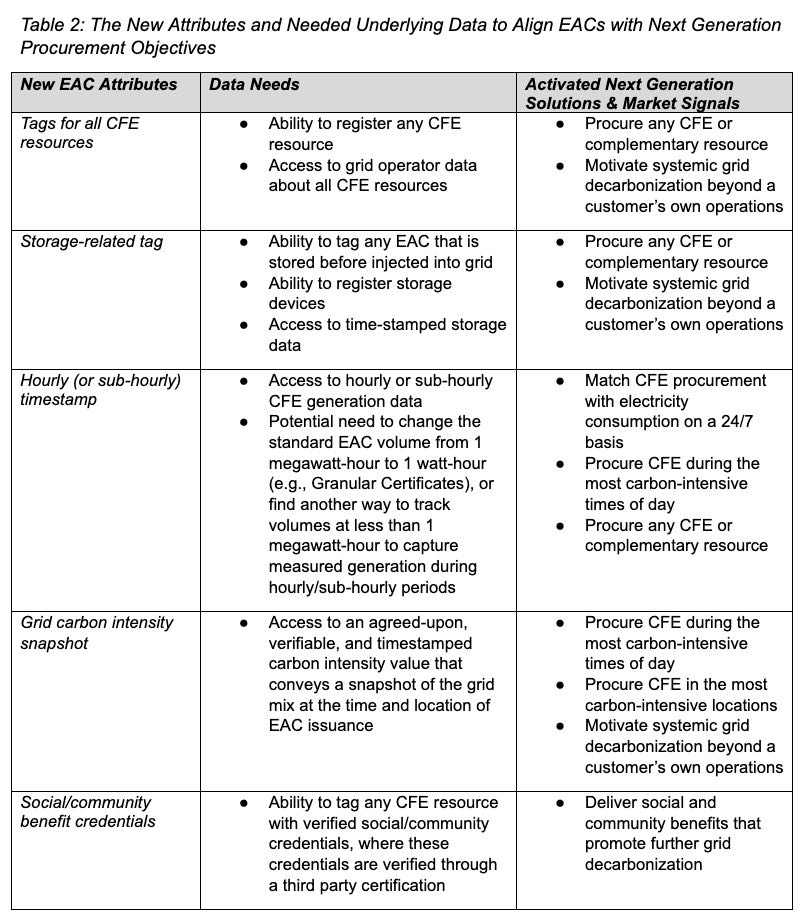

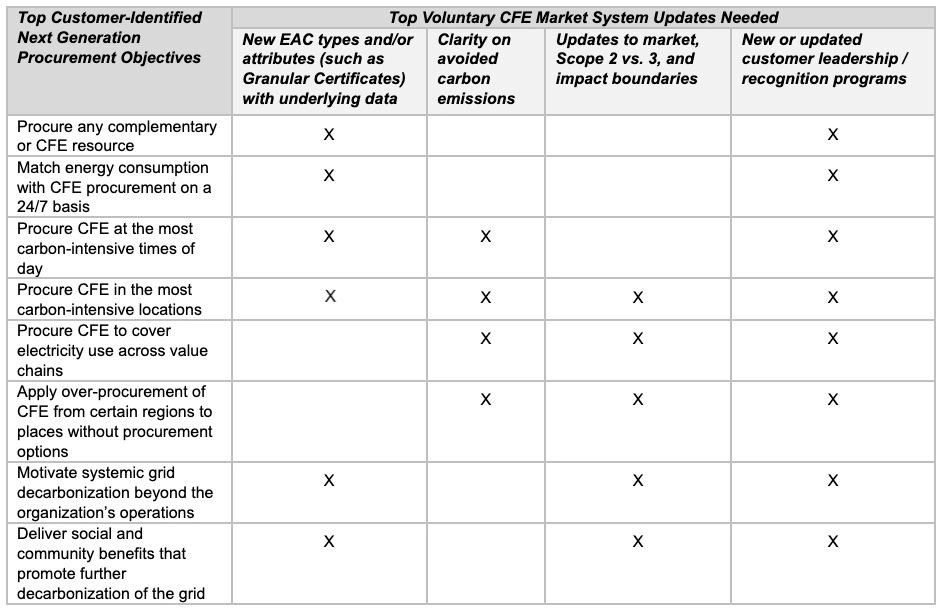

There is an opportunity for energy attribute certificate (EAC) issuing bodies and registries to new important attributes on EACs applicable to next generation procurement solutions and better serve as a “platform of platforms” for diverse clean energy solution providers and data providers. EAC issuing bodies and registries can unleash a new era of carbon-free procurement and solution innovation by implementing two types of updates in their systems: capturing five key new attributes—including tags for all carbon-free electricity (CFE) resources, tags for complementary resources, (sub-)hourly timestamps, grid carbon intensity snapshots, and tags for social/community credentials—and offering modern automated programming interfaces (APIs).

The Clean Energy Buyers Institute (CEBI) has been engaging with EAC issuing bodies and registries to identify and understand various potential solutions to address the governance, data access, technical, and resourcing barriers they face to implement these updates. In the latest workshop in the NextGen Activator workshop series, EAC issuing bodies and registries examined each of these potential solutions. This workshop provided insights addressing two central questions:

Question #1: How can EAC issuing bodies and registries make updates to their systems, such as capturing new EAC attributes and offering new technical functionalities like modern APIs?

Insight #1: The governance- and approvals-related process varies across EAC markets, where there are two sides of the coin to consider. Some EAC issuing bodies and registries have greater capacity and flexibility to implement changes faster, whereas others have greater capacity to implement updates in a more consistent, integrated way.

Any EAC issuing body or registry that wants to update their system must follow established protocol and processes to get necessary internal approvals and resources. It is no surprise that across the 10 U.S. renewable energy certificate (REC) registries, 25 European guarantee of origin (GO) issuing bodies, and the 50+ countries in Africa, Asia, and Latin America that issue international renewable energy certificates (I-RECs) that these processes vary.

To a certain extent, EAC issuing bodies and registries that have greater autonomy and decision-making agility can more easily implement updates to activate next generation procurement. For example, I-REC and select U.S. REC markets have processes for approvals and updates that appear poised to move fastest with enabling next generation procurement, whereas these approvals and updates will likely take more time in European GO markets because extensive regulatory approvals apply at the European Union level by the European Commission in Brussels.

Table 1 below summarizes the notable governance and implementation rollout differences between U.S. REC, European GO, and I-REC markets:

Table 1: Summary of Governance and Implementation Factors for EAC Issuing Bodies to Implement System Updates

| EAC Issuers | Governance Structure | Implementation Scope | Main Impediment to Implementation |

|---|---|---|---|

| U.S. REC registries | Varies across the 10 U.S. REC registries | Varies across the 10 U.S. REC registries | Inconsistencies across U.S. REC registries, where registries with greater autonomy and data access can move faster |

| European GO issuing bodies | The European Commission (EC) in coordination with the Association of Issuing Bodies (AIB) | Following approval, updates apply across all 25 GO issuing bodies’ systems | Time-intensive approvals process, but following approvals any update has consistent EU-wide adoption |

| I-REC issuing bodies | The I-REC Standard Foundation in coordination with national I-REC issuers and other stakeholders | Following approval, any I-REC issuing body and Evident (the technology system for I-REC issuance and tracking) can choose to make updates following new guidance in the I-REC Standard | While I-REC markets can theoretically adopt updates the fastest, there are limitations and country-by-country variations around granular data access for new EAC attributes |

Let’s consider why I-REC and select U.S. REC markets may make updates fastest:

- I-REC markets can likely integrate any combination of the five new EAC attributes into the I-REC Standard with the greatest relative ease compared to more complex and/or diverse governance processes in REC and GO markets since it is one body (I-REC Standard Foundation) that oversees this standard in operation in 50+ countries. Furthermore, the fact that all I-REC markets use one technical system—run by Evident—means that any new EAC attributes and technical functionality Evident offers can take wide geographic effect quickly.

- M-RETS, which issues and tracks RECs for most of the U.S. Midwest, can make decisions and implement updates more swiftly than other U.S. registries because it is structured as a nonprofit and does not have to go through same regulatory or stakeholder processes as other registries to make changes

However, the relative speed of the governance process might not make I-REC markets the first to adopt new EAC attributes. First, the data that EAC issuing bodies and registries need so they can add these five new attributes are more readily available in the U.S. and European markets compared to the countries that issue I-RECs. Upon adoption, newly available EAC attributes may be more consistently available in GO rather than I-REC or REC markets. This is because updates to European GO markets come from Brussels to promote European Union market integration and consistency.

Question #2: What else can support EAC issuing bodies and registries with accelerating the implementation of these updates to their systems?

Insight #2: Practical tools, such as template legal agreements that define API terms, can make it easier for EAC issuing bodies and registries to expedite updates once they have internal clearance to proceed.

There are opportunities that exist today to develop practical tools that will help expedite updates once issuing bodies and registries get the clearance they need to proceed with implementation.

For example, workshop participants proposed a concept for a generic template legal agreement that sets the basic terms for how a given data provider, trading platform, and other solution providers can use a given EAC issuing body or registry’s APIs to interact with their system. EAC issuing bodies and registries can use and modify this template legal agreement to expedite the process and reduce administrative costs associated with enabling whitelisted data providers or trading platforms to, respectively, deliver new data or sync trading activity with EAC issuing body and registry systems. These template agreements would also help create greater consistency for data providers, trading platforms, and solution providers that offer services across EAC markets—helping to scale the adoption of innovative solutions.

These insights are informing CEBI’s NextGen Activator Community Guide that CEBI will publish in mid/late September that specifies the ways to update the four pillars underpinning the current CFE market system—the EACs, underlying data, customer leadership programs, and greenhouse gas accounting guidelines—to activate new CFE procurement solutions that meet customers’ next generation procurement objectives.

The next workshop CEBI is convening as part of the NextGen Activator series will pivot the focus of discussion to another pillar of CEBI’s NextGen Initiative: greenhouse gas accounting. During this workshop, CEBI and participants will review opportunities to clarify and gap-fill areas in the Greenhouse Gas Protocol’s Scope 2 Guidance to better support various next generation procurement scenarios.

We hope you will join us on Monday, August 22nd at 2PM U.S. Eastern (register here).